Detailed Information on Insurance CRM

What is Insurance CRM?

Insurance CRM frequently used term which has two implications, i) The on-ground relationship management and ii) The on-software management. An Insurance CRM software is a solution's software which stores business data, contacts and provides means to monitor and comprehend the business growth while reducing work-load for employees and magnifying productivity.

An Insurance CRM relatively lets you achieve more business goals by automating & aligning minor and major sales activities.

An Insurance CRM provides your business with all the possible information and tools needed to expand faster.

The Insurance industry landscape in India:

The Indian Insurance industry comprises of various insurance provider enterprises for wide ranging insurance categories. The Indian Insurance industry sees a huge number of companies from the private as well as public sector and has sold above 350 million policies. The Indian insurance industry being one of the largest world-wide promises a higher penetration level across various markets. It also is looking at a hike in it's contribution towards the GDP. An Insurance CRM comes into play when mastering sales in totality becomes a priority, it gives befitting answers for wiser decision making.

1) The Insurance Industry at a glance:

Since there are many participants in the insurance business there is a mix of organizations from both the private as well as public sector. There is a single public sector giant and many more from the private sector have a common structure. There are director level, higher managerial, regional head individuals, etc. that head organizations and spear-head business teams to take charge of revenue decisions. On the other hand, there are numerous teams that are hands-on for executing and strategizing in the real revenue generation activities. So every multinational and large enterprise as well as SME has a set number of processes and tasks for large numbers of clients and workforce. With a central focus to complete planned returns, Insurance businesses have moved their point of interest towards Insurance CRM (Customer relationship Management) softwares.

A critical phase every Insurance business needs to pass to escalate the sales process is complete prospect knowledge.

An Insurance CRM encapsulates all the required sales aspects, from handling the lead enquiry to selling a policy.

It provides an enveloping solution to improve all the sales and business activities.

2) How an Insurance CRM (Customer Relationship Management) Software helps the Insurance industry:

An Insurance CRM practically adds method to all the madness by simplifying every task that is included in accelerating sales and executing the same effectively.

An Insurance CRM provides a centralized storage and helps smoothen the data-seeking and obtaining process for all. It helps manage and store contact data of all clients and leads and provides a better understanding of the client-base.

An insurance crm software streamlines lead conversion processes and helps quicker approvals with right sharing. An Insurance business would evidently find a difference in it's and it's teams' perfomrance as an insurance crm helps set targets, monitor performance of sales and sales executives. It also, helps identify selling opportunities with a customer database.

In short, an insurance crm software helps businesses progress and perform with agility while simplifying it's regular course of action.

Key Reasons why your Insurance business needs a CRM software:

A business would benefit with an insurance crm software by...

1. A quick and precise view of ones insurance business and all clients purchase cycle. Giving you the supremacy of executing well estimated actions to get two fold outcomes.

2. Grow wallet-share and client base effectively. Scan the minutest details about your sales.

3. Identify opportunities to up-sell and cross-sell.

4. A centralized, systematic and sharable storage for of all customer, lead, sales and business data.

5. Complete monitoring of sales and all the branches.

6. Have knowledge of the sold and unsold products and services both quantity-wise & price-wise.

7. Profuse customer and lead follow-up routines through a single point communication for emails, calls and sms.

8. Access to critical data on computers, laptops, tabs and smart phones.

9. Get an electronic documentation of your sales performance in the form of updated analytical data.

10. Shoot payment schedule reminders to clients. A crm lets you remain assured that there's a system in place to induce punctual client payments.

11. The Insurance CRM can integrate with your existing ERP, Accounting and other softwares for good functionality.

How our CRM Software can help an insurance business:

With new entrants in the insurance industry, there has been a massive increase in competitiveness as there are insurance for health, life, vehicles, travel, property and a lot more.

Despite this, the business revolves around the customer and his needs to insure which needs a in-depth understanding and appropriate brief about the clients or lead in order to provide a suitable insurance and achieve the ultimate goal of gaining more revenue eventually. Wanting more benchmarks and knowing how to achieve them always help in capturing the crux of the situation.This however, has many layers of analysis and monitoring without which the execution would fall flat.

Which is why ,any insurance businesses resort to buying a crm solution. So when you need a CRM, it is important to be able to identify the best crm software that can be suitable for your business. These pointers will show you how our insurance crm software is different from all the available CRM Software companies in India (or over-seas):

We provide a variety of hosting options for your large / medium / small business. You can choose a hosting on either of these highly secure amazon servers, VPS, dedicated servers, local servers, on the website ( hosted on Linux server ) or shared Linux hosting.

Get in touch with us to suggest what's best for you!

1) Multiple Hosting options:

A. Web-based / SAAS based Insurance CRM Software:

A centrally hosted CRM hosting with a subscription basis licensing. The expanding Indian industry serves as a highly favorable market space for "on-demand" / customer relationship management (CRM).

B. On Premise Insurance Software i.e. on your online servers:

Hosted on the client's online server on a subscription basis licensing.

Know which type of CRM hosting works best for your Insurance business, i.e. Cloud CRM or On Premise CRM? Get in touch with our CRM solution experts.

2) Seamless Integration: Our Insurance CRM integrates with most ERPs, accounting softwares and others.

3) Customisation options:Easily customize our Insurance CRM as per your business needs so you can have the best CRM software experience.

4) Multiple device accessibility: Access critical data and sales reports on the move i.e. on desktops, tablets, mobiles, etc.

5) Maintain product and branch details: Keep a record of products quantity-wise and type-wise to know your product status.

6) Forecast Sales: Know the current growth trend and foresee your Insurance company's weekly, monthly, quarterly & yearly possible growth. Get detailed sales forecast reports on revenue and leads in our Insurance CRM to strategize better.

7) Monitor sales team performance: Get daily performance reports of sales persons from all branches to reward them accordingly. Get a clear perspective of sales and discover your organization's growth curve.

8) Sales target setting: Set targets for sales with detailed sales and lead reports on a daily, monthly, quarterly, biyearly and yearly basis.

9) Effective product marketing: Increase your recall value, automate emailers and messages to your leads and clients with updates.

10) Schedule meetings & visits: Schedule visits, meetings and maintain a log of their details.

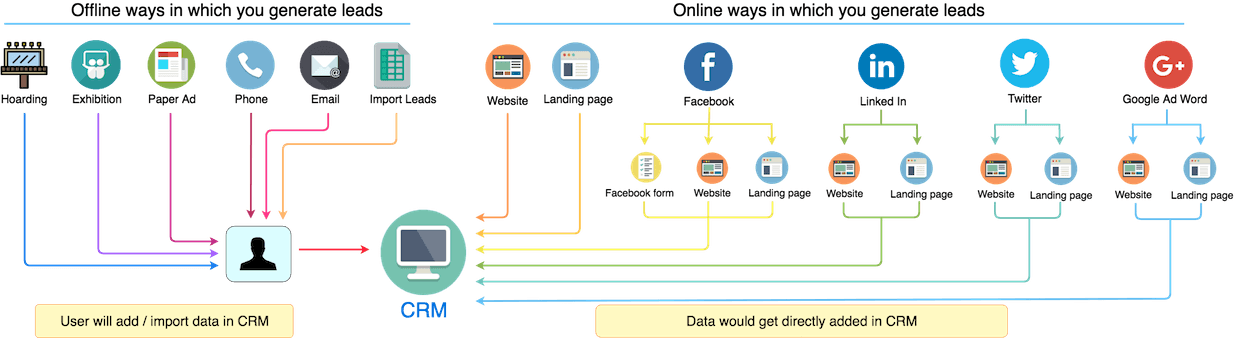

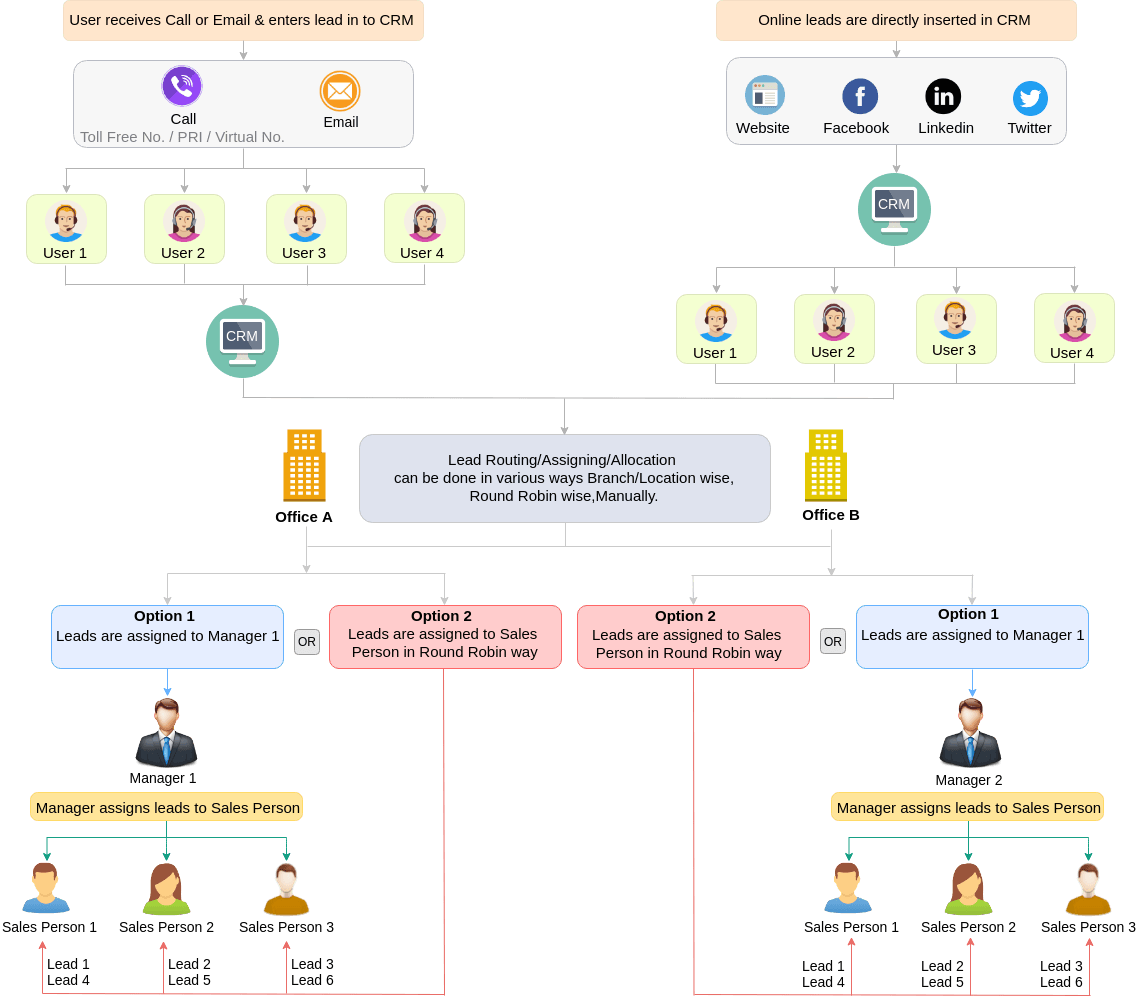

11) Capture more leads: Save excessive resource wastage by keeping a record of all the sales enquiries, leads generated, follow ups, branches, etc. Never miss a lead, set reminders for calls, site visits, emails, messages, important dates, etc.

12) More productive employee base: Tag clients, leads, sales people to share prime data to close more deals and help them stay afloat with updated knowledge about all the advances in the sales scenario of your banking business.

13) Bird's eye view: Stay updated with dashboard and reports give you a quick and correct view of your insurance business.

Using an Insurance CRM magnifies your chances of converting leads and generating more revenue for your organization. An insurance crm not only facilitates flawless functioning for itself but also makes your sales teams more effective with managing leads and following-up. You get an expansive view of all your policies, leads, clients and stay updated with details of each. An insurance crm is a complete console that can give you direct control and vision as to everything happening in your business with a smart dashboard. In-depth reports let you dig deeper and make better strategic business decisions. Plus, an insurance crm empowers you with a window into the real time activities of your sales people & agents.

To know more about CRM and the 17 industries we cater to, visit www.dquip.com.

Related Content From Our Blog:

Manage sales teams effectively for Insurance Business with CRM | Convert more leads with CRM for Insurance Business | Managing contacts for Insurance business in a CRM | Retaining Clients in Insurance business with CRM | Insurance CRM gives effective Sales Target Management! | Insurance CRM Featurelist | Comprehensive information on Insurance CRM - Part 2 | Comprehensive information on Insurance CRM - Part 1 | Insurance CRM features in a business flow | How Insurance CRM increases profits and performance | Lead Management For Insurance Business | How to track, monitor and achieve Sales Targets for Insurance business | Factsheet on Insurance CRM | 7 Reasons For Buying An Insurance CRM | 7 Things To Do Before Buying An Insurance CRM | Checklist for Buying Insurance CRM | Insurance CRM Features and Functionalities Infographic | Insurance CRM Buyers Guide | Top 6 Features of Insurance CRM Software | Basic information on Insurance CRM

We have 200+ clients spread across India, Australia, U.S.A, U.K, Africa, Hong Kong and Singapore. In India, we have clients in almost all states.

We have sales people as well as industry-wise crm pages for the following states and cities in India:

Maharashtra- Mumbai, Thane, Navi Mumbai, Pune, Nashik, Kolhapur, Nagpur | Gujarat - Ahmedabad, Surat | Punjab - Chandigarh, Amritsar, Ludhiana, Mohali, Patiala, Jalandhar & Bathinda | TamilNadu - Chennai, Coimbatore | Karnataka - Bangalore | WestBengal - Kolkata | Delhi, Delhi NCR, Gurgaon, Noida | Uttar Pradesh - Lucknow | Telangana - Hyderabad | Bihar - Patna | Rajasthan - Jaipur, Udaipur | Madhya Pradesh - Bhopal

Get in touch with our CRM solution specialist to know more on how our CRM can help your business.

Contact us now!