Detailed Information on Banking CRM

What is Banking CRM?

You have heard the term Banking CRM frequently used in the banking space but are not very aware of it is meaning and existence. To begin with, CRM (Customer Relationship Management) is a solution or a software which enables a business organization to improve their sales and productive performance by exquisitely managing data of all sorts that would be key to the business. A Banking CRM specifically helps banks manage their sales and revenue generation activities by giving better performance, more transparency and greater customer efficiency. A CRM for Banks enables achievement of higher sales targets with unified and aligned electronic execution of sales activities.

A Banking CRM is a complete kit to get detailed insights to manage your customer facing sales and scale your business.

The Indian Banking Industry Landscape:

The banking industry though going through the great global depression has seen an rise in the recent years. The Indian banking industry has however benefited and experienced an impending growth and the number of consumer banks, community banks, mega banks, etc. has increased drastically. The Indian banking scenario in India at present is such that the Indian banking sectors assets were above 1.5 trillion in the past year.

This is a clear indication that with a greater technology base, improving economic capabilities of the masses, excessively competitive approaches the number of commercial, community, retail banks has increased. As a consequence of a highly changing market and greater competition, banks have shifted their focus from being product-centric to being customer-centric. Hence, it has become prime to know your customers needs and create products and build strategies around your customers needs in order to grow.

With a manifold of activities that go on in every bank on a day-to-day basis and with an ever-increasing customer base there has also been a reduced ratio of walk-in enquiries. Hence, it has become a high priority to have all the essential knowledge and details of your prospective customers. Having a banking crm creates a bank of all these details can help a bank sales teams provide every prospect a customised experience which is a two-way benefit for both the prospect and the bank.

A banking crm software also streamlines daily activities, provides analytical insights, etc. and helps banks monitor and strategise their plans in accordance with their current revenue growth. A crm for banks provides observable enhancements in the overall sales from follow-up to conversion phases; it also empower decision makers with cutting-edge clarity.

So basically, a banking crm helps banks up-lift their sales and services; this makes it a responsible task to select the most appropriate one out of all the banking crm companies you would evaluate for your bank.

1) Structural Overview of the Banking Industry:

Mega banks specifically have a lot of branches and sub-branches as they deal with customers on a global level, which means they have a greater network of hierarchy from C-execs to banking sales officers. For example a leading bank giant would typically have branches in more than 40 countries. Mega banks mostly have consumer banking as a segmented part of their services. They provide brokerage services which have consumer banking, finance provision and extensive services such as online & phone banking in addition to the investor services, corporate banking, etc. On the other hand, retail banks become a comparatively more segmented type of banking which solely caters to consumer activities such as working in several branches and teams, depending on the size of the bank. Community banks however are best known for providing customer experiences as they are comparatively smaller banks and provide services in consumer banking with basic banking services and financial assistance and loan provision for a confined number of customers. Their niche is strong enough for their employees to know entire families.

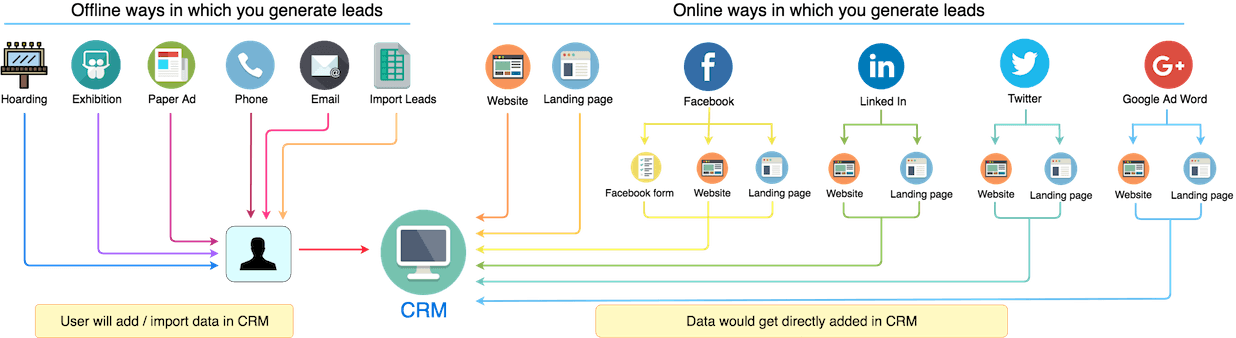

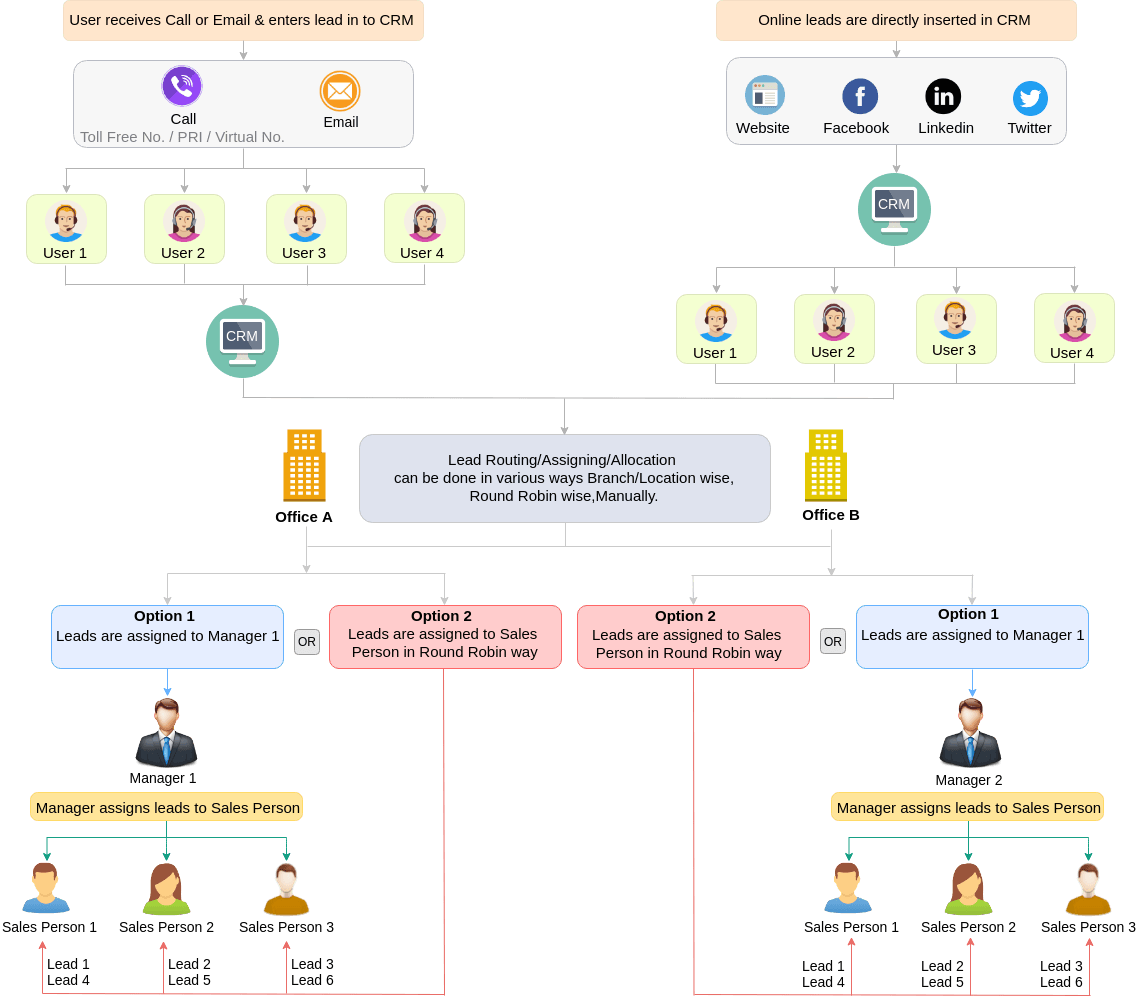

The bottomline concern for all these types of banks is their customer base. For every kind of bank that involves itself in consumer banking the customer is their core and revenue growth is a primary aim meant to attain. For the goal attainment of these, every bank needs to successfully manage their clientele, map the sources of generated leads (i.e from convert a marginally progressive number of leads, strategise activities to promote and grow sales and much more which are made manageable and actionable with a banking crm.

Banks can get hamstrung if their big-data (i.e their prospect and company details, product specifications, etc.) is not organised and stored, their strategies are not rock-solid and promising due to a lack of clarity in the performance of their branches and employees. Untraced, un-followed and unrecorded leads can also add to the mass of malfunction that can result into a complete chaos. To procure completion of higher business expansion Banks have shifted their efforts on using Banking CRM Customer relationship Management softwares.

One major concern all types of banking businesses have is to convert lead enquiries into concrete bank visits to further the stage of the sales cycle.

A Banking CRM provides a much required cushioning to have a compact sales cycle from the walk-in enquiry to an account opening.

It is a prominent solution kit to solve various business concerns and undertake activities.

2) How a CRM Software can help the banking industry:

Having a banking crm software actually provides agility to the day to day banking processes as it streamlines all the regular activities involved in a banking system.

It helps centrally store all the prospect details and keeps a record of all the enquiries which helps the bank convert more leads by actively knowing & effectively following-up on all the leads.

It provides absolute transparency and lets higher officials monitor the regular sales activities, follow-ups, performance on lead conversions, revenue growth trends, etc. to enhance productivity and reduce spill-overs and resource wastage.

It makes communication for all the bank sales team employees integrated with emails, calls and messages both for internal purposes as well as to communicate with prospective clients.

Key Reasons why a bank would use a Bank CRM Software:

Using a Banking CRM is highly recommended if.

1. A comprehensive view of your prospects progressive stages. Hence, providing an advantage of making well estimated actions for the best outcomes.

2. Complete monitoring of sales and all the branches. Scale through every details about your sales.

3. Increase wallet-share and client base effectively.

4. Know the products that each client is interested in using and would possibly buy.

5. Want to know the favourable products or services to suggest and sell effectively.

6. Have knowledge of the sold and unsold products and services both quantity-wise & price-wise.

7. A common storage with systematic sand-boxing of all customers (remove), leads, sales and business sales data.

8. Avail critical reports to analyze and keep a tab on sales performance of your organization and sales people.

9. Hassle-free customer servicing and effective follow-up routines through emails, calls and messaging integrated at a single point.

10. View critical data on multiple devices i.e. computers, laptops, tabs and smart phones.

11. Send & schedule alerts to existing clients for timely payments. You can thus be assured that you're inducing a system that will ensure your customers to pay-up on time.

12. The seamless integration of the Banking CRM with your existing ERP and Accounting softwares, helps make sure you enjoy complete functionality with the CRM.

How our Banking CRM (Customer Relationship Management) Software can help you:

Every Bank business needs to have an exponential growth rate while balancing it is sales oriented temperament with their customer-centric approach.

Since the Banking Industry, like every industry has adopted and developed several means of technology it has become increasingly essential to have every activity automated and clearly organized to meet their unique set of needs.

So when you need a CRM for your bank, it is natural that you would evaluate all the available CRM Software companies in India because you want the best banking crm for your business.

These following pointers helps you understand how our software can serve your business:

We provide a variety of hosting options for your large / medium / small business. You can choose a hosting on either of these highly secure amazon servers, VPS, dedicated servers, local servers, on the website ( hosted on Linux server ) or shared Linux hosting.

Get in touch with us to suggest what's best for you!

1) Multiple Hosting options:

A. Web-based / SAAS based Banking CRM Software:

A centrally hosted CRM hosting with a subscription basis licensing. With the Indian banking industry being one of the largest revenue contributors, it also serves as a highly favorable market space for "on-demand" / customer relationship management (CRM). Our Banking CRM can serves as a SaaS (software as a service).

B. On Premise Banking CRM Software i.e. on your online servers:

Hosted on the client's online server on a subscription basis licensing.

Get in touch with our CRM specialist to know the best CRM hosting for your Bank, i.e. Web based CRM or On Premise.

2) Customization: Our Banking CRM lets you customize as per your business necessities so you can have the best CRM software experience.

3) Seamless Integration: You need not worry about the integration as our Banking CRM is compatible for integration with most ERPs, accounting softwares and others.

4) Easy accessibility on multiple devices: Freely access critical prospect data and sales reports on the move i.e. on desktops, tablets, mobiles, etc.

5) Maintain product and branch details: Keep a record of revenued and quantitative products and services to have a tab on the progress of your business.

6) Sales target setting: Set targets for sales with detailed sales and lead reports on a daily, monthly, quarterly, bi-yearly and yearly basis.

7) Monitor sales team performance: Get daily performance reports of sales persons to reward them accordingly. Have a clear view of sales at your disposal and know your bank's growth dynamics.

8) Schedule meetings & visits: Schedule visits, meetings and maintain a log of their details.

9) Effective product marketing: Increase your recall value, send and schedule automated emailers and messages to your leads with new & important bank updates.

10) Forecast Bank's Sales: Know the current growth trend and foresee your bank's weekly, monthly, quarterly & yearly prospective growth. Make strategies with the help of insightful and detailed sales forecast reports on revenue, leads, etc. in our Bank CRM software.

11) Capture more leads: Save excessive resource wastage by keeping a record of all the sales enquiries, leads generated, follow ups, branches, etc. Never miss a lead, set reminders for calls, site visits, emails, messages, important dates, etc.

12) Get a panoramic view of your business: Easy to view dashboard and reports give you a complete view of your bank's business. Gives you a real-time picture of all the sales activities and communications and helps in making sound decisions.

13) Have a better informed employee base: Tag leads & sales people to share prime data to close more deals and help them stay afloat with updated knowledge about all the advances in the sales scenario of your banking business.

Using a Banking CRM can be an impending need to multiply your business quicker. Banking crm can enhance business relations and quicken the lead conversion process. Banks can enjoy achievement of sales target resulting in better overall performance. A banking crm can help you observe and analyze the performance of your sales executives in real time. Banking CRM is your complete console irrespective of your business size.

To know more about CRM and the 17 industries we cater to, visit www.dquip.com.

Related Content From Our Blog:

Managing contacts for Banking Business in CRM | Manage sales teams effectively for Banking business with CRM | Banking businesses can convert more Leads with CRM! | Banking CRM gives effective Sales Target Management | Maintaining Client data for Banking business with CRM | Maximize lead follow-up efficiency with CRM for Banking business | Increase profits & efficiency for Banking business with a CRM | Banking CRM Featurelist | Summary of CRM for Banking Industry - Part 2 | Summary of CRM for Banking Industry Part 1 | CRM and its flow in Banking business | 7 tips to scale your Banking business with a CRM! | 5 Key CRM reports for Banking business | Track, follow-up and manage leads for Banking business | Banking CRM Key Features and Functionalities Infographic | How to track, monitor and achieve Sales Targets for Banking business? | Factsheet on Banking CRM | Buyers Guide For Banking CRM Software | Checklist for Buying Banking CRM | 6 Key Features of Banking CRM | Banking CRM Software

We have 200+ clients spread across India, Australia, U.S.A, U.K, Africa, Hong Kong and Singapore. In India, we have clients in almost all states.

We have sales people as well as industry-wise crm pages for the following states and cities in India:

Maharashtra- Mumbai, Thane, Navi Mumbai, Pune, Nashik, Kolhapur, Nagpur | Gujarat - Ahmedabad, Surat | Punjab - Chandigarh, Amritsar, Ludhiana, Mohali, Patiala, Jalandhar & Bathinda | TamilNadu - Chennai, Coimbatore | Karnataka - Bangalore | WestBengal - Kolkata | Delhi, Delhi NCR, Gurgaon, Noida | Uttar Pradesh - Lucknow | Telangana - Hyderabad | Bihar - Patna | Rajasthan - Jaipur, Udaipur | Madhya Pradesh - Bhopal

Get in touch with our CRM solution specialist to know more on how our CRM can help your business.

Contact us now!